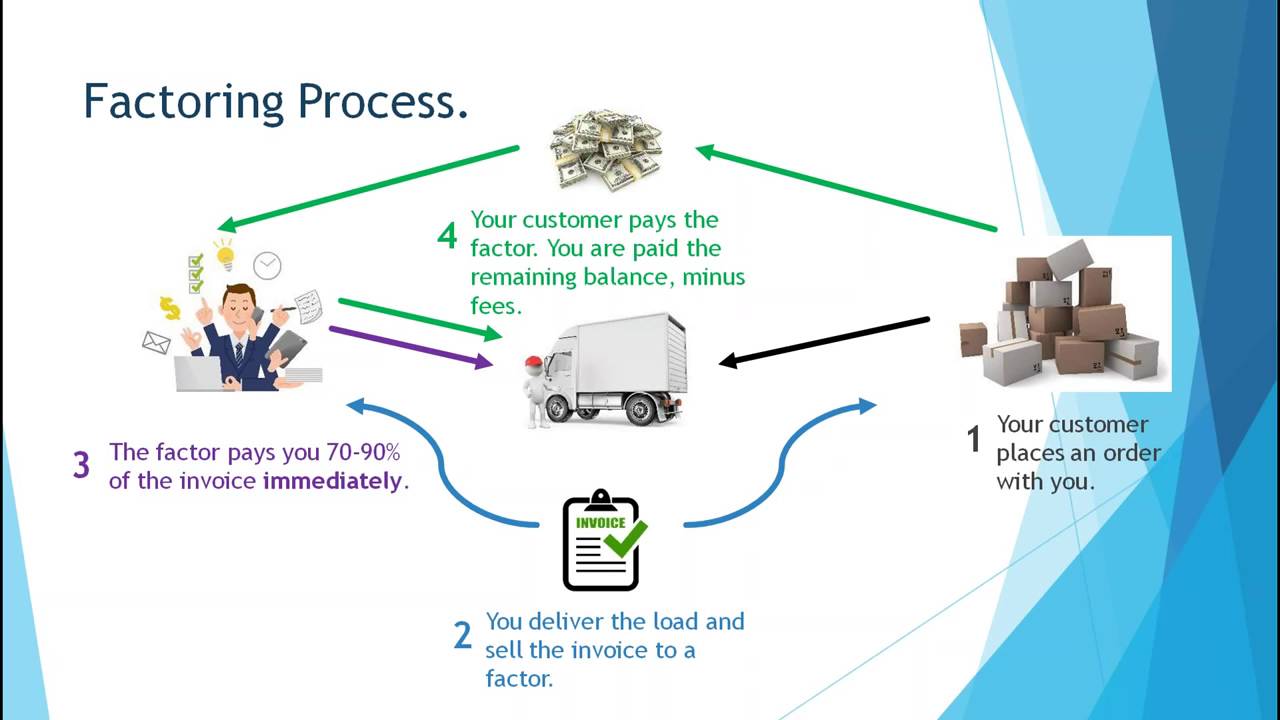

Unfavorable contract terms (depending on the company): There are many differences in the ways that companies can structure their factoring terms and fees. When you consider the additional services that are included in the fee, factoring looks even more favorable. Lastly, factoring is more than just the access to funding. Factoring is also typically more affordable than other forms of lending such as merchant cash advances (MCAs) that come with aggressive repayment plans. However, if you are considering factoring, it’s probably because you have a need that is not being met by those forms of lending. Also, the sometimes “hard” conversations about invoice payments are handled by the factoring company, which allows you to keep your focus on customer service and growth opportunities.Ĭost: Factoring is not as affordable as traditional loans or lines of credit. Improved customer relationships: Factoring allows you to be flexible with your customer payment terms, because your payment comes from the factoring company the same day you sell the invoice. So long as your customers maintain their credit and remain current on their payments, there is no cap like there would be with more traditional forms of lending. Unlimited funding growth potential: With factoring, your funding grows as your company grows. Increased efficiency: Outsourcing the administrative tasks of invoicing and collections frees up time to focus on initiatives that grow your business. The factoring company just accepts their factoring fee upon being repaid by your customer. This depends upon how quickly the factoring company can get your account set up with your customer(s).Īvoid debt / No repayment plan: Because factoring is not a loan, there is no liability (debt) created, so there is no need for a repayment plan. In most cases, a factoring company requires a short application and a few documents to verify your identity/background, company structure, and customers.įast cash: Once your company is approved and your account is setup, you can typically begin funding within a few days, if not the same day. Less paperwork: Due to the above, there is typically not a need for an in-depth review of all of your financial statements. This means your approval is not based upon your credit score, profitability, length of time in business, collateral, and in some cases, background issues. Therefore, factoring companies are concerned with your customers’ business credit. The reasons for this, as compared to more traditional forms of lending, include:Īpproval based on your customers’ creditworthiness: The factoring company will be repaid by your customer(s). Quick and easy approval: Factoring approval is typically done within 1-2 days, if not within just a few hours.

It should be the goal of a factoring company to be paid as quickly as possible (according to your payment terms) for a smooth Accounts Receivable process that limits the risk to your company. Good factoring companies have strong operational procedures that track invoice status and raise alerts when needed. While this may sound limiting at first, it is designed to protect your company from customers that have a risky credit profile.Īnother way risk is mitigated is through the factoring company’s collections services. Factors will approve or reject invoices based on your customers’ credit.

In this way, factoring companies have an interest in helping you limit the risk of slow-payment, or worse yet, non-payment.Ĭredit checks and analysis are a standard feature of a factoring partnership. One important thing to remember is that a factoring company’s success depends on its customers’ success. In this way, factoring is more than a cash advance on your unpaid invoices - it’s an operational tool that can also save your business money. In cases where you choose to factor all customer accounts, your Accounts Receivable operation essentially becomes outsourced to the factoring company, which may even lead to personnel savings.

#Factoring invoices for dummies free

Business Efficiencyįactoring companies provide invoicing and collections services that free up your company resources. You’re simply selling one asset (A/R) for another asset (cash). Rather than waiting for payment on unpaid invoices, factoring advances the cash tied up in your Accounts Receivable without taking on debt or losing equity. When cash flow shortages occur, factoring can help you overcome cash flow issues.

Special projects or initiatives that require investment This may be due to factors such as:īeing denied a bank loan or access to a line of credit Companies use invoice factoring when there is a shortage in the cash needed to operate the business.

0 kommentar(er)

0 kommentar(er)